![]() December 22, 2025

December 22, 2025

More than 60 percent of foreign entrepreneurs choose a Dubai mainland company for its unmatched market reach and flexibility compared to other business setups. For any American business owner aiming to expand internationally, understanding what truly defines a Dubai mainland company can make or break your investment success. This guide unpacks the essential rules, ownership models, and market advantages that set mainland businesses in Dubai apart so you can make confident, informed decisions.

| Point | Details |

|---|---|

| Mainland Company Overview | A Dubai Mainland Company operates under UAE law, allowing for unrestricted business activities across the UAE, requiring local Emirati ownership. |

| Types of Licenses | Companies can obtain licenses such as Trading, Professional, and Industrial, each with unique operational focuses and compliance requirements. |

| Ownership Structures | Local sponsorship is essential, typically involving either a Local Service Agent or a Local Partner Model to ensure compliance and shareholding stability. |

| Financial Obligations | Entrepreneurs must budget for initial setup costs and ongoing operational expenses, navigating a favorable tax environment while ensuring compliance with financial regulations. |

A Dubai Mainland Company represents a business entity established directly within the Emirate of Dubai’s primary jurisdiction, operating under the legal framework of the United Arab Emirates. Unlike free zone companies, mainland businesses can conduct commercial activities throughout the UAE without geographical restrictions, offering entrepreneurs comprehensive market access.

Mainland companies in Dubai are characterized by specific structural and legal requirements that distinguish them from other business formations. They mandate local Emirati ownership, typically requiring a local sponsor who holds a minimum 51% ownership stake in the business. This ownership structure ensures compliance with UAE’s commercial regulations and promotes national economic participation. Companies can be established as various legal entities, including Limited Liability Companies (LLCs), sole proprietorships, and civil companies, each with unique operational parameters.

The primary differentiating factors of a Dubai mainland company include unrestricted geographical business operations, ability to bid on government contracts, direct access to local and federal markets, and the potential to obtain business licenses across multiple commercial activities. Dubai mainland company registration provides businesses the flexibility to work with both public and private sector entities without the spatial limitations encountered in free zone setups.

Pro Tip for Entrepreneurs: Research local sponsorship arrangements thoroughly before establishing your mainland company, as the specific terms of your local partner agreement can significantly impact your business’s long-term strategic flexibility and operational autonomy.

Dubai mainland companies can obtain several distinct types of commercial licenses that define their operational scope and legal permissions. These licenses are categorized based on specific business activities, enabling entrepreneurs to select the most appropriate authorization for their commercial objectives. Commercial licenses in Dubai represent critical documentation that determines a company’s legal framework and permissible business interactions.

The primary mainland license categories include:

Each license type carries unique requirements and restrictions. Trading licenses, for instance, allow companies to conduct wholesale and retail commerce, while professional licenses focus on service-based activities that require specialized skills or expertise. Industrial licenses provide authorization for manufacturing enterprises, supporting Dubai’s broader economic diversification strategies.

Entrepreneurs must carefully evaluate their business model and intended activities to select the most appropriate license category. The selection process involves assessing operational needs, understanding regulatory constraints, and aligning with local economic guidelines. Specific license types may require additional documentation, professional qualifications, or specific infrastructure investments to maintain compliance with Dubai’s rigorous commercial regulations.

Pro Tip for Business Planning: Consult with a local business setup expert to precisely match your business activities with the most suitable mainland license type, ensuring seamless regulatory compliance and minimizing potential administrative challenges.

Here’s how the main types of mainland licenses differ by focus and compliance:

| License Type | Primary Business Focus | Key Compliance Requirement |

|---|---|---|

| Trading License | Product sales and distribution | Proven capital and trade records |

| Professional License | Service provision and consulting | Professional qualifications |

| Industrial License | Manufacturing and production | Dedicated industrial premises |

Dubai mainland companies operate under unique ownership regulations that distinguish them from other business structures in the United Arab Emirates. Company registration in Dubai mandates specific shareholding requirements designed to balance foreign investment opportunities with local economic interests. The most critical rule involves local Emirati ownership, which typically necessitates that a United Arab Emirates national or a company owned by UAE nationals hold a minimum 51% ownership stake in the business entity.

The local sponsorship model comes in two primary variations:

Local Service Agent (LSA) Model:

Local Partner Model:

Contrary to common misconceptions, these ownership structures are not permanent barriers but strategic mechanisms to integrate foreign businesses into the local economic ecosystem. Sophisticated investors can negotiate comprehensive agreements that protect foreign shareholders’ interests while maintaining legal compliance. Some arrangements allow for creative shareholding structures, financial compensation mechanisms, and clearly defined operational autonomies that mitigate potential partnership challenges.

Pro Tip for International Investors: Engage a local legal consultant specializing in UAE corporate law to design a comprehensive shareholding agreement that protects your business interests while ensuring full regulatory compliance with Dubai’s mainland company regulations.

Dubai mainland company registration involves a structured, multi-step process that requires careful navigation of local regulatory requirements. Company registration in Dubai demands meticulous preparation and understanding of official procedures to ensure smooth business establishment. The journey begins with comprehensive documentation and strategic planning to meet the Dubai Department of Economic Development’s stringent guidelines.

The typical registration process encompasses several critical stages:

Entrepreneurs must understand that each business activity carries unique compliance nuances. Professional services might require additional professional qualifications, while trading businesses need extensive documentation proving financial stability and intended commercial operations. The registration timeline typically ranges from two to four weeks, depending on the complexity of the business structure and the completeness of submitted documentation.

Pro Tip for Smooth Registration: Engage a professional business setup consultant who understands the intricate details of Dubai’s mainland company registration to streamline your application process and minimize potential administrative complications.

Financial management for Dubai mainland companies involves understanding a complex landscape of initial setup expenses and recurring regulatory obligations. Company registration in Dubai requires entrepreneurs to budget for multiple financial commitments beyond standard establishment costs. The financial framework encompasses initial registration fees, annual renewal expenses, and potential additional investments in local compliance infrastructure.

Typical cost breakdown for mainland companies includes:

Initial Establishment Costs:

Ongoing Financial Obligations:

The United Arab Emirates offers a uniquely attractive tax environment for businesses. While mainland companies must navigate specific regulatory requirements, they benefit from zero personal income tax, zero corporate tax for most industries, and no direct taxation on corporate profits. However, companies must maintain rigorous financial documentation, submit regular reports to economic departments, and comply with transparent accounting standards. Entrepreneurs should anticipate additional expenses related to local bank account maintenance, potential government service fees, and periodic regulatory compliance audits.

Pro Tip for Financial Planning: Maintain a dedicated financial buffer of approximately 15-20% above your estimated operational costs to accommodate unexpected regulatory expenses and potential administrative requirements in Dubai’s dynamic business landscape.

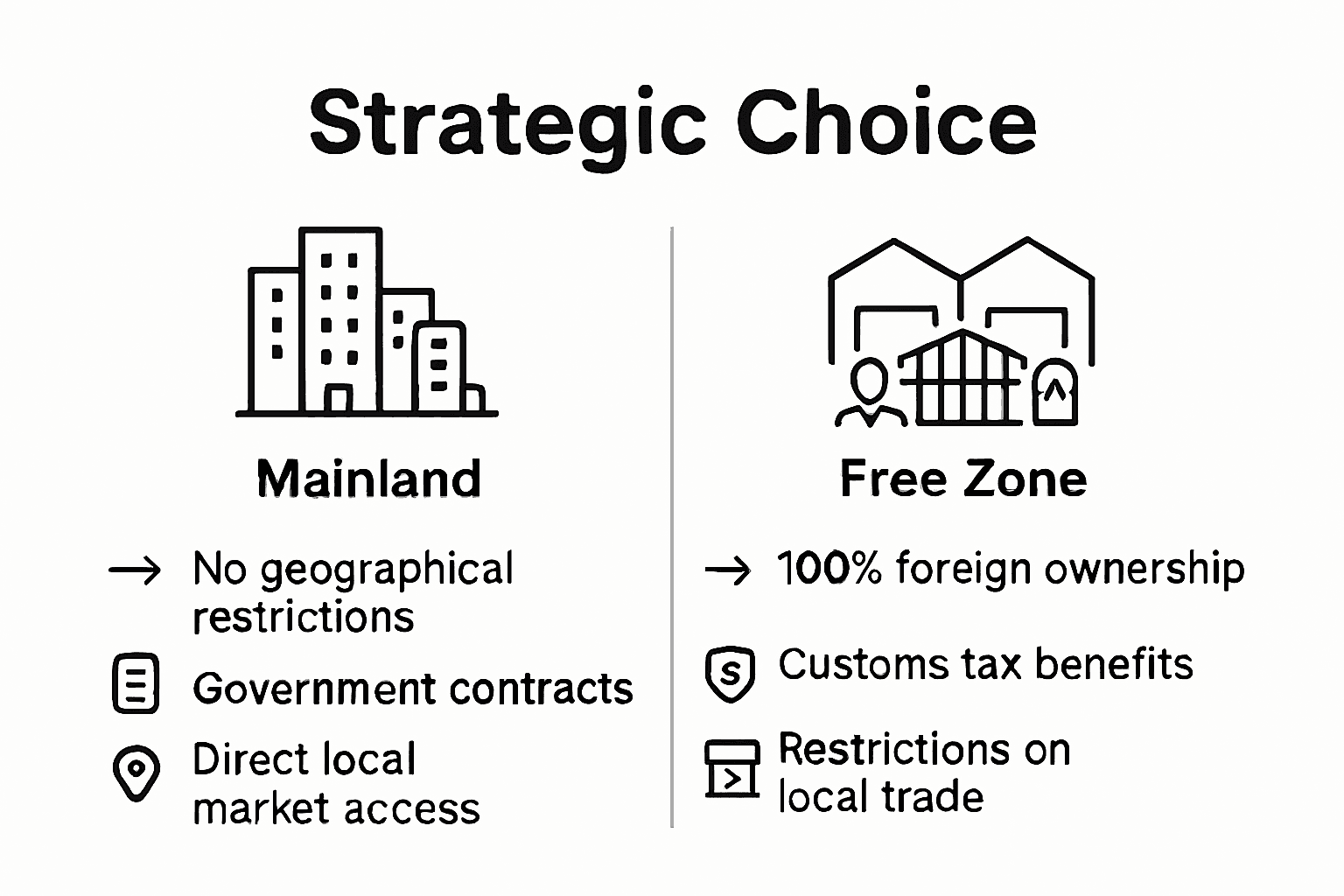

Business structure selection represents a critical strategic decision for entrepreneurs entering the Dubai market. Company registration in Dubai offers two primary establishment models: mainland and free zone companies, each with distinct operational characteristics and regulatory frameworks. Understanding the nuanced differences between these structures can significantly impact business performance and long-term growth potential.

Key comparative aspects include:

Mainland Company Characteristics:

Free Zone Company Characteristics:

The selection between mainland and free zone structures depends on multiple factors including business objectives, industry type, operational flexibility requirements, and long-term market engagement strategies. Mainland companies offer comprehensive market penetration but demand more complex regulatory compliance, while free zones provide streamlined setup processes with specific operational constraints. Entrepreneurs must carefully evaluate their specific business model, growth aspirations, and regulatory tolerance to make an informed decision.

The following table summarizes the core strengths and limitations of Dubai mainland and free zone companies:

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Entire UAE and overseas | Mainly within free zone, some international |

| Foreign Ownership | Up to 49% (in most cases) | 100% for foreign investors |

| Regulatory Complexity | Higher, more approvals needed | Lower, streamlined processes |

| Business Location | Flexible across Dubai/UAE | Restricted to specific free zone |

Pro Tip for Strategic Selection: Conduct a comprehensive business model analysis and consult with local corporate advisors to determine whether a mainland or free zone structure aligns most effectively with your specific commercial objectives and operational requirements.

Navigating the complex ownership rules and compliance steps involved in establishing a Dubai Mainland Company can feel overwhelming. From understanding the 51 percent local ownership requirement to selecting the right commercial license and managing government approvals, entrepreneurs must tackle many challenges to unlock full UAE market access. If you want to avoid common pitfalls and secure a smooth registration process, expert assistance is essential.

Take control of your business journey with professional guidance from SetupDubaiBusiness.com. Our team specializes in helping international investors and SMEs handle every detail of business formation, including sponsorship arrangements, licensing selection, and regulatory compliance. Don’t let administrative hurdles delay your launch. Visit SetupDubaiBusiness.com now and get personalized support to establish your Dubai mainland company efficiently and with confidence.

A Dubai mainland company is a business entity that operates under the local jurisdiction of Dubai, allowing comprehensive market access across the UAE without geographical restrictions.

The main advantages include unrestricted geographical operations, the ability to bid on government contracts, direct access to local and federal markets, and the option to engage in various commercial activities.

Dubai mainland companies can obtain different types of licenses, including trading licenses for buying and selling goods, professional licenses for service-based businesses, and industrial licenses for manufacturing activities.

A Dubai mainland company typically requires local Emirati ownership, with a minimum of 51% of the shares held by a local partner or sponsor, ensuring compliance with UAE commercial regulations.

Get a Quote

WhatsApp